How can I pay rent in a pandemic?

As we approach the one-year mark of the COVID-19 pandemic here in the United States, this question weighs heavily on the minds of about one in five renters.

In December, it was estimated that the nationwide eviction crisis would put 11.4 million households more than three months behind on their rent payments by the new year. With each of these households owing an average of $6,000 two months ago and a relief package still delayed, American renters collectively owe over $70 billion in past-due rent, late fees and unpaid utility bills.

Yet, as damaging as the pandemic has been for the financial situation of our nation’s renters, this question is certainly not a new one. “How can I pay rent?” has been an increasingly difficult question to answer for years now – “in a pandemic” is only a recent addition.

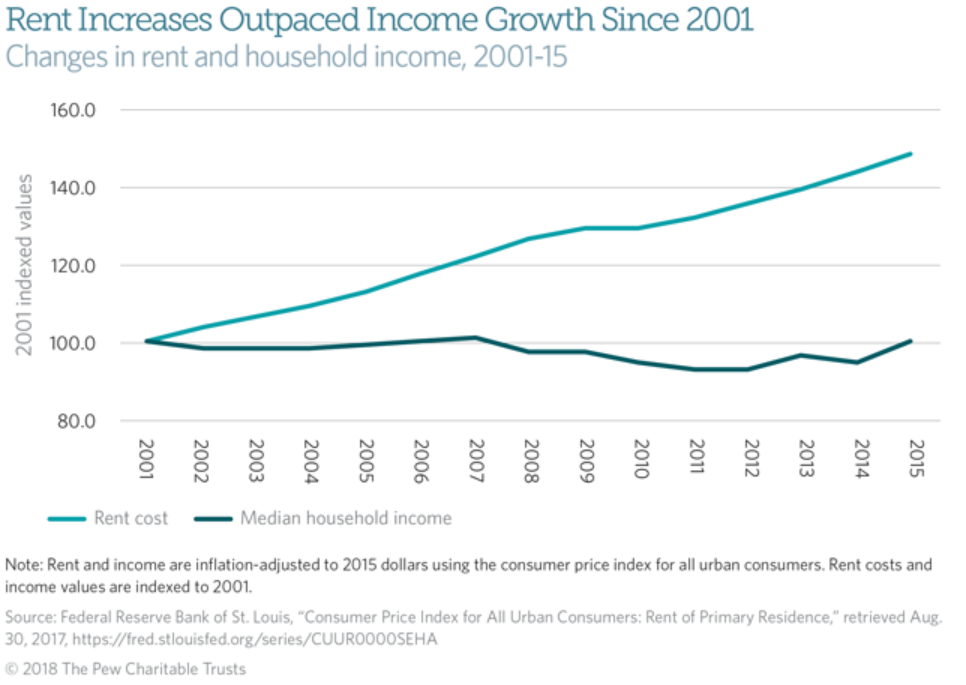

As seen in the chart above, rents have steadily risen since the turn of the century, while the median household income has stagnated or fallen. This means that renters have been forced to spend a higher percentage of their income on housing over the last 20 years, leaving less money available for other expenditures or savings. As a result, renters were already vulnerable before the pandemic and accompanying economic downturn – conditions that have exacerbated underlying housing problems and presently put millions at risk of eviction.

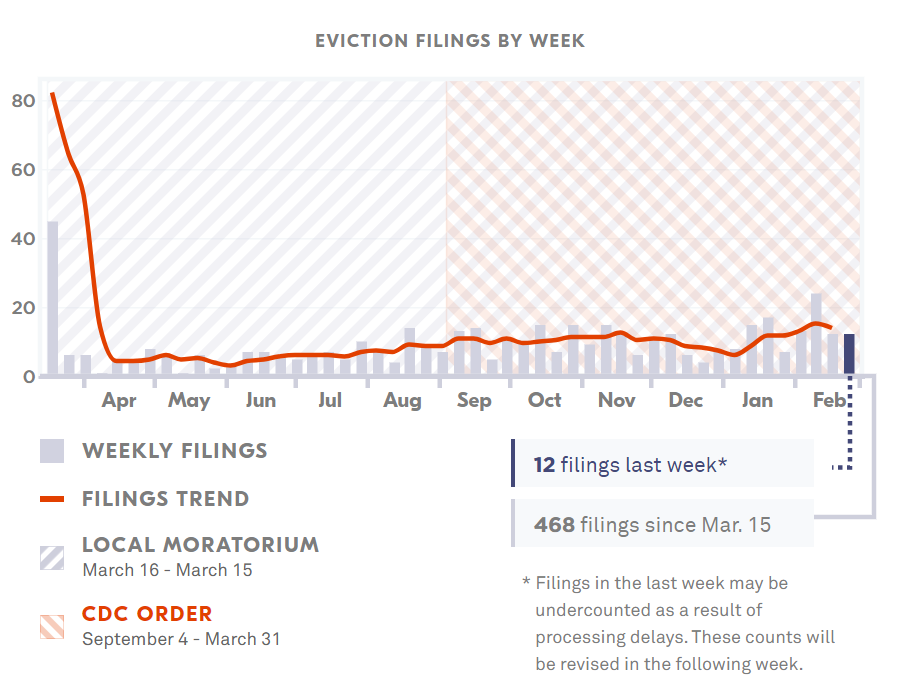

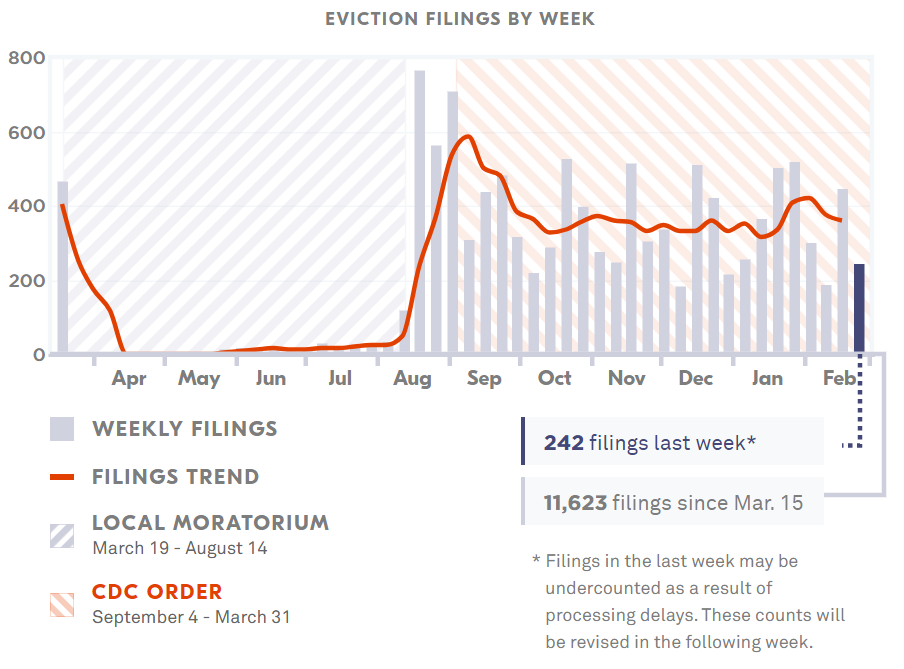

Aside from stimulus checks or higher unemployment benefits, the most common methods for governments to address the eviction crisis have been eviction moratoria in various forms. At the federal level, the current CDC eviction moratorium was issued on Sept. 1 of last year and later extended to last through March 31, 2021, in response to an Executive Order from President Biden upon his inauguration. State and local governments have also passed temporary eviction protection measures that have prevented the “tsunami” of evictions feared by housing advocates.

However, despite a federal eviction moratorium and the patchwork of state and local protections, data collected by Princeton University’s Eviction Lab shows that evictions never really stopped happening.

Federal moratoriums alone were not enough to stop or, in some cases, even reduce the number of eviction filings in U.S. cities. Overlapping federal and state/local regulations were necessary to achieve meaningful eviction prevention, and the latter proved much more effective in pushing evictions toward zero in certain places. In general, state/local regulations have been more comprehensive than the federal moratorium, often protecting against no-fault evictions or hold-over evictions for tenants whose lease has ended in addition to the federal protections for nonpayment of rent. For a more in-depth look at the differences between federal and state/local eviction protections, check out this article from Bloomberg CityLab.

The First Nationwide Evictions Database

If you are interested in researching the pandemic eviction crisis further, I recommend taking a look at the Eviction Lab’s interactive tools, COVID-19 resources and published reports. With national data stretching back to 2000 and pandemic-specific information on 5 states and 27 cities, the Eviction Lab information was instrumental in helping me to better understand evictions in the U.S. and was cited by many of the other sources I ended up reading.

The Eviction Lab is led by Matthew Desmond, who also wrote “Evicted: Poverty & Profit in the American City.” (Check out Erika’s takeaways from reading this great book too!) According to its website, the Eviction Lab is the first dataset of evictions in the U.S. and was founded with the belief that a stable, affordable home is central to human flourishing and economic mobility. Thus, understanding eviction and its effects “is foundational to understanding poverty in America,” and the lab has collected formal eviction records, local demographic information and statistics on landlord-tenant cases that, collectively, amount to all the known eviction information available in the U.S.

Highlights and Takeaways

I hope this article provided some helpful background knowledge for your thinking about evictions during a pandemic, but there is so much more information and many more resources for anyone who wants to learn more about this topic. I highlighted the Eviction Lab, in particular, because of its innovative and approachable insights into such a complicated issue. Here are a few of its tools and reports that I found most interesting, but I would also encourage you to do some digging of your own!

- Trend graphics from the Eviction Lab’s Eviction Tracking System show the number of weekly eviction filings with the status of federal and local moratoria.

- Notice how the three cities with the fewest eviction filings since last March (Minneapolis-St. Paul, Bridgeport and Austin) have all kept local protections strong throughout the pandemic.

- In New York, local protections have twice led to a steep decline in eviction filings, whereas the federal moratorium had little effect on its own.

- Houston and Phoenix, two cities with very high numbers of eviction filings, both achieved significant eviction reductions with local protections at the beginning of the pandemic. Since those protections were removed, eviction filing rates have been among the highest in the country.

- Indianapolis and Cleveland are two of the most jarring examples, with filings near zero under local protections before skyrocketing immediately after their removal.

- Housing Policy Scorecards are another fantastic resource related to evictions during the pandemic. These state ratings “distill the contents of thousands of emergency orders, declarations, and legislation” to show what these states are doing, how long these measures last and how effective they are.

- In addition to excellent graphics and metrics, the Eviction Lab is producing some top-notch analysis and reporting based on their data. Here are some of my favorites: